May 19, 2025

Dear Investors, Underwriters and Friends,

The first quarter of 2025 was one for completing renovations and executing on

leases. We experimented with different finishes in our kitchens, which resulted in a

slight increase in renovation costs, but also generated a boost to the eventual rental

figure. All in, the finishes cost us an additional $1,600 and generated roughly $780

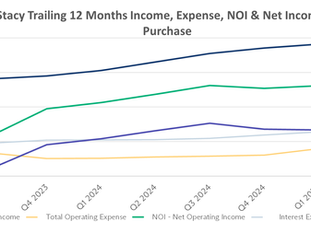

per year in income. Here is a look at the trailing 12 Month income by quarter:

After accounting for the capital returned to investors during this year, this net

income constitutes an 8.3% return on investor capital. That figure should continue

to tick up as the leases that executed this quarter are actually in place for a full year,

particularly if we can execute on our tenant retention strategy.

We have a quote to install impact glass in all three buildings using Wright Impact

Glass. They are not the lease expensive quote, but they are a high quality outfit and

they also allow us to finance the installation. We are still considering the options,

but if we financed the impact glass installation it would cost roughly $1,700 per

month over a ten year term. There are no pre-payment penalties and the loan can

be paid off at our discretion.

Depending on the performance of our scheduled renovations, we expect to resume

distributions, on a quarterly basis at the end of Q2 2025. The first set of

distributions were the result of accessing the remainder of our financing and we

think the property should be essentially stabilized within the next 4-5 months.

For now, we will continue to work on our property and endeavor to generate larger

earnings for all of you. Thank you again for your trust and support.

-Clem