July 25, 2025

Corbin Turrell Real Estate Partnership

PO Box 256 West Palm Beach, FL 33402

Dear Investors,

The second quarter, like the first, ended with a bang. After ending Q1 by agreeing to sell 510 43rd to a local family office, we went under contract on a new property right at the end of Q2 in order to use the 1031 exchange produced by the Q1 sale. 2701 Avenue E is a 22 unit apartment building in Riviera Beach, just across the bridge from Singer Island and roughly 6 blocks from the newly constructed Nautilus 220 building. With additional development sites surrounding this property, we are enthusiastic about the location, but we are also equally enthusiastic about exchanging from a 12 unit building with a rent roll of roughly $16,000 at sale to a 22 unit building with a rent roll of approximately $47,000, all while keeping our loan to value below 60% on the purchase. The property is currently operated as Section 8 housing, which is housing subsidized by the government through a voucher program. It is well run and will continue to be so. Our end goal is to convert the property to market rate rents as rental rates rise in Riviera Beach. There is a significant difference in the price buyers will pay for Section 8 properties (we paid a 7.25% cap rate) and what they will pay for market rate properties (comparable capitalization rates are roughly 5.25-5.5%). That cap rate compression, along with the tailwinds of the surrounding developments is where we expect to make our return on this property. Until then, we will focus on efficient management and rent collection.

The portfolio overall is focused on just that. Improving our management until the

final apartments at Indigo and 233 Wenonah come online. During the quarter we

added to our software stack in an attempt to improve our tenant screening process,

as well as our lease-up speed. First, we added Rent Butter, a platform that assists

us in evaluating rental applications. This doesn't cost us anything on net since we

pass the additional cost ($15 more than Appfolio's internal application) on to the

applicant. Rent Butter uses their proprietary algorithm to provide advanced

predictive analytics on each applicant. Its platform ingests real-time financial data

(like bank transaction history, income flow, rent payment behavior, and credit trends)

into a composite score that forecasts future reliability. Essentially, their system

does the difficult manual work of sifting through individual applicants when they are

hard to parse upon first glance. They go beyond just a credit score and give us a

good idea when a 600 credit score tenant is a better risk than one with a 700 credit

score. Next, we added Tenant Turner which increases the ease with which our

leasing agents show vacant units. It makes contactless showings possible for the

first time by acting as a platform solely interested in the filling of vacancies. It

scrapes information from our Appfolio system and then is a place where our leasing

agents can spend their time focused on matching tenants and apartments. In our

pipeline are Smart Maintenance, an AI Dispatcher native to Appfolio, that will allow

for 24/7 coverage of our apartments, Second Nature, a platform that bundles

household items (such as AC air filters and refrigerator water filters) and ships them

directly to tenants, charging the tenant for the cost and an admin fee and Elise AI, an

AI chat bot, which purports to act as the first line of communication on both the

leasing and management side. Adding these technologies will allow us to continue

to keep a lean crew of maintenance techs, even as we expand our portfolios, which,

in turn, keeps operating expenses down overall. Already we have reallocated

resources by stripping every property of their "assigned property manager" in favor

of property technicians with daily duties who can be dispatched to whichever

property needs their attention. This means that more eyes, each with a narrower

expertise, can be focused on each individual property throughout the week. Instead

of one man with his particular weaknesses and strengths showing up at the same

property day in and out, it is three or four individuals rotating through the property,

each looking for different issues.

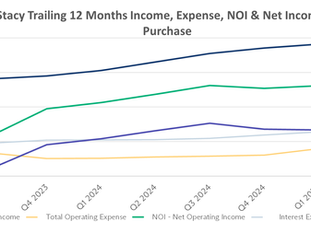

Our income statement is a mixed-bag at the moment. Utility expenses year-to-date

are down 22%, only a couple percent of which is due to the sale of 510 43rd.

Similarly, landscaping costs are down 33% as we brought some of the work inhouse.

Insurance is up, but it is up in a way that makes it difficult to read on the

income statement. We transitioned both 4011 36th Court and 233 Wenonah Place

from their quarterly builder's risk policies to an annual policy with Citizen's. This

means that we paid for two quarters worth of builder's risk insurance during the first

6 months, as well as 12 months of a more typical policy, or 18 months of total

insurance. Thus, we are paid up on insurance at those two properties until July

2026. Still, rates ticked up at both properties as we moved onto new plans. Our

all-in, per-unit cost at 4011 36th Court increased from $1,046/unit to $1,654/unit,

a 58.1% increase. That rate at 4011 36th Court will fall back down below $1,100

per door as we finish our renovation and exit hurricane season (allowing us to move

the final two buildings onto the Citizen's plan). While we are keeping a watchful

eye on expenses, we view the current situation to be a temporary bump in the road

resulting from strange timing and the intricacies of insurance.

Additionally, total rental income also deserves watching as it dropped from

$460,000 to $400,000 from Q1 to Q2. The first culprit is, of course, the absence of

510 43rd, which account eared just over $51,000 in income during Q1. Add to that

the large turn at 5207 N Flagler ($18,000 in lost income) and the two units under

renovation at 2919 Broadway ($7,800 in lost income) and it is obvious why income

fell quarter-over-quarter. We expect the units at 5207 N Flagler and 2919

Broadway to lease during Q3 (adding projected monthly income of $9,700) and the

purchase of 2701 Avenue E, which will take effect on 8/13/2025, should add

approximately $47,000 to the monthly rent roll when fully occupied.

Shoring up our vacancies is a goal as 2026 has new units being delivered into the

Northwood market (and the state of Florida overall). While we do not believe these

units to be direct competitors to ours, they could put downward pressure on rents if

vacancies persist. Further, given current immigration policies, there are growing

concerns over a slowdown in working age immigration negatively impacting

apartment rent growth. Florida has far more A&B Class units in the pipeline, as a

percentage of total inventory (18%), than the nation as a whole (6.5%), but without

population growth from immigration there may not be the working age residents to

fill those apartments and keep the state's vacancy rate at its current level of roughly

5%. While C Class apartments have very, very different supply and demand

dynamics, they are not completely immune from vacancy rates in newer apartments

with nicer amenities. If you have to cut rental prices at the apartment with the pool,

you may, eventually, have to cut the price at the apartment without one. None of

this negates our overall thesis of overperformance in Class C apartment buildings,

but it does force us to focus on management to ensure continued performance.

Next year promises to bring not just the deliveries of new apartment units, but also

the chance for acquisitions. The uncertainty caused by immigration policy combined

with the expiration of numerous pandemic-era commercial loans is likely to lead

certain owners to sell into a market without a large number of buyers. Those of us

with access to capital should be prepared to take advantage, particularly because

any policy that can be enacted at the stroke of a pen can be undone as quickly. Take

a look at the large number of under-performing loans in this region. If even a small

share (10-15%) of these require disposition by their owners, it will mean a surge in

buying opportunities.

As always, thank you for your support. Please let me know if you have any

questions or comments.

Regards,

Clem