The first quarter of 2024 is in the books and we can announce that we successfully completed our project at 3012 Broadway, including the draw of an addition $710,000 from Locality Bank, which was predicated on the successful leasing of the property. Locality underwrote their loan with the assumption that we would lease our units for $1,250 per month and our current average rent is $1,472. That spread made the completion of the loan relatively painless, though there was a brief hang-up due to the good people at the City of West Palm Beach having trouble finalizing a couple permits in their computer system.

The next two properties to complete their renovation projects and enter stabilization will be 4011 36th Court and 233 Wenonah. 4011 36th Court has four of tis 6 buildings now leased and demolition permits have been pulled for the final two buildings. 233 Wenonah continues to be delayed by the historic zoning commission. We have agreed to all their requests regarding the stucco texture of the building, but, at each point of contact, they take the maximum amount of time to respond. They even go as far as to write e-mails explaining that they have another week to respond to a simple 'yes' or 'no' question. We are very hopeful that this is the final week of our involvement with the Historic Commission as they have until April 6th to respond confirming that we may proceed.

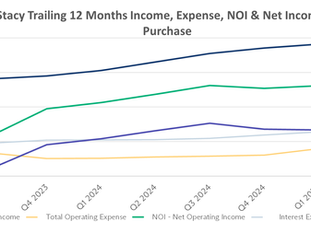

The first quarter saw an increase, year-over-year, of our total income from $199,000 to $473,000, the result of 4011 36th Court being leased. Taking a longer look, we generated $831,000 of income over the past 6 months, as compared to $673,000 of expenses, including interest. We look back at 6 months of income to account for the bulk of our tax payments. Roughly 75% of our total taxes were paid during the past 6 months, meaning the other 6 months of the year are a good deal more profitable. Insurance is more evenly distributed right now with roughly 45% coming due between October and March and the balance being paid during the other half of the year. Over the past 6 months, leasing fees have increased in a significant way as we have leased previously vacant apartments at 3012 Broadway and 4011 36th Court. While we have negotiated deal with a local realtor at Pavon Realty to pay a reduced rate (1/2 a months rent, as opposed to a full month), leasing commissions, along with what we pay to Zillow to ensure proper advertising placement for 4011 36th Court, accounted for nearly 5% of expenses over the past 6 months, up from less than 0.1% the year before. This figures to come back down by the end of 2024 or the middle of 2025 at the latest as two things change. First, we will no longer be paying Zillow upwards of $700 per month simply to have rental listings for the apartments appear on their website. With 4011 36th Court fully occupied, it makes little sense to make that a monthly payment. No other property requires such a payment as 4011 36th Court is the only property with more than 40 units. In addition, the frequency with which we pay realtor fees goes down significantly as we stabilize and going from empty to full is the most expensive time. With that time behind us for 3012 Broadway and 4011 36th Court, we can expect fewer leasing expenses as we move forward. Pest Control expenses have also risen to 1.7% of expenses, nearly 10 times what they were in the previous year. This is the result of the roll out of far more preventative treatment across the portfolio and is counteracted by Pest Control Income being generated at the stabilized units. Now that we have picked the low hanging fruit, in terms of insisting on Pest Control Fees at our highest quality properties, we will begin to institute the fee at other locations. This will typically occur at lease renewal and we will then add the $30 per month pest control charge on top of the rent. As a result, that expense is not going away, but it will be balanced by additional income as lease renewals arrive in the spring. Similarly, we will be instituting new or additional utility fees, depending on the property, at the next round of lease renewals to account for increased energy costs. Our electric costs are up nearly 20% year over year and while some of that is due to opening and holding open electric account for vacant units as they wait to be leased, the majority of it is the result of increased rates. Our goal is to generate utility income equal to at least 50% of our electric utilities by year end 2024.

Overall, 2023 was a very successful year. The thanks for that goes primarily to you, our investors and underwriters for your patience and support, but also to our property technicians, Felipe, Juan, Walter, Rayder and Eddie, who have maintained a very high level of service for our tenants while we underwent a very large renovation of nearly half our portfolio.

3012 Broadway, now named the Gwendolyn Apartments, is completed and eleven of the sixteen units leased in the first month of operations (December 2023). Rents are between $800 and $900 (123%-138%) per apartment per month higher than they were when we purchased the property.

We have begun the process of reviewing financing options for 233 Wenonah, both to complete the project and for after completion. The loan comes due at the end of Q1 2025, so we are issuing pro-forma to bankers with how we expect it to lease. In those pro-formas we are providing two sets of rents for evaluation:

1) The rents we expect: $2,000 for a one bedroom and $1,700 for a studio

2) The rents the bank will underwrite at $1,450 per studio and $1,750 for a 1/1.

Any loan we agree to will need to be covered by the lower rents. This allows us some margin for error with what the bank underwrites and typically keeps our debt to asset ratio lower when we execute successfully. We will continue to update both on the progress at Wenonah and decisions regarding financing. Thanks again. Please let me know if there are any questions.

Regards,

Clem