Q1 2024 CT Stacy Road Management Report

Apr 24, 2024

2 min read

0

3

0

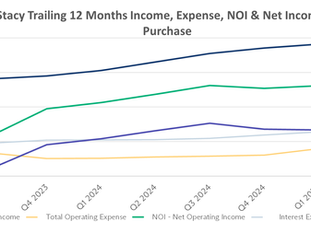

After approximately 18 months, 5214 Stacy Road is beginning to stabilize with over half the units either renovated and leased (11 apartments) or in some stage of renovation (3 apartments). Our first quarter net income of $50,554, more than double that of Q1 2023, tells us as much. That it a perfectly acceptable rate (7.1%, annualized), given our equity investment and the proportion of apartments renovated leased to date. It is not a stretch to presume the return will be higher as more apartments are renovated. Additionally, our property experienced its sixth consecutive month of 100% rent collection. An achievement we attribute to the combination of new tenants joining the mix and our property manager being on-site nearly every day overseeing renovations.

Our most recent leases have been executed at $2,395 per month, down slightly from $2,450, though still above the $2,350 we expected for the first two years. With completions of multi-family apartments on the rise and starts falling, prices will eventually be pulled up by the influx of new households into South Florida. New inventory will be filled and there will be a lack of supply to meet the demand coming from these new households. National net immigration was 2.5 million, according to estimates by Goldman Sachs, driving a national population growth of 3.8 million people for 2023. Florida is among the leaders by nearly any measure when it comes to population growth, net immigration or net inbound migration. Essentially, Florida added nearly 1% to its population from immigrants and nearly 1% to its population from inbound migrants relocating from other states. Depending on which numbers you use, the total population growth was between 1.6% and 2.0%.

So, with more demand incoming and a slowdown in construction starts, both locally

and nationally, we expect our rent to pick back up in the coming years.

Operating expenditures have held steady quarter-over-quarter, meaning all of our

rent increases have flowed to the bottom line. Our goal is to improve upon the the

operating expenditures as more and more renovated units are leased. There is a

dynamic going on within the property of legacy tenants, those we inherited,

generating far more repair and maintenance requests than the newer tenants. This

makes sense because the new tenants are living in a newly renovated space.

However, we also see the legacy tenants making more requests than we would

otherwise expect and we believe it is the result of them having been accustomed to

paying a below market rent ($1,395/month), so when they are asked to pay a higher

rent they decided, consciously or not, to "get their money's worth". The sample

sizes are small, but we are beginning to track some data here to see whether we

can improve on this going forward.

We look forward to Q2 when we expect to lease these three outstanding

renovations (one is nearly ready for leasing as of writing). Once that is complete, we

expect to have a conversation with our bankers to see where we stand in regards to

drawing on the $1 million remaining on our loan. Those funds can then be used for

further capital improvements and to return to investors.

Thanks to all of you for your support. Please let me know if you have any questions

or comments.

-Clem