Q2 2024 CT Stacy Road, Management Report Letter

Jul 29, 2024

3 min read

0

14

0

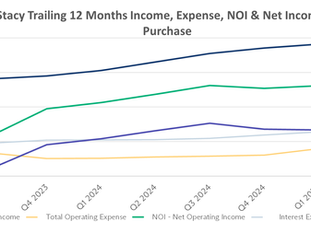

After approximately 21 months, 5214 Stacy Road is essentially stabilized. Our total income has grown now from $24,479 in the first quarter of 2023 to $52,950 this past quarter, our second consecutive quarterly net income above $50,000. That quarterly income will drop as we draw additional debt on the building and will climb back up over the next 12 months as we complete the remaining apartments in the apartment and bring the building fully up to market rents. During Q3, you should expect a return of capital, the result of this preliminary stabilization.

Our last couple leases have gone back to executing at $2,450 per month, an encouraging sign that, as the building becomes more and more renovated, the rents will climb past their present levels. That will include a the resurfacing of the parking lot and repainting the buildings, but the costs to those improvements is fairly low and should help attract an even higher quality tenant to the property. In our last letter we discussed the eventual price increase we expected to see down the road as demand caught up to supply. Essentially, as construction starts slow, permit applications dwindle and current projects are completed the glut of multifamily housing will be absorbed and demand, which is being maintained by a growing local population, will cause prices to rise in light of that shrinking supply. More data has come to light which doesn't disprove that thinking but adds more nuance to it. CoStar published the following data last month showing that properties such as 5214 Stacy have held up exceptionally well in value as of late and the implication is that the majority of deliveries are occurring on the high-end of the multi-family real estate market:

Essentially, CoStar's data, which is limited to South Florida multifamily is showing that 1 & 2 star properties have held up well in terms of value, vacancies and rent growth in comparison to 4 & 5 star properties. There are some reasons to be a bit skeptical of the data. One, is that it makes us feel good and that is reason enough to examine it extra hard. Another is that CoStar is generally less accurate at lower ends of the "quality" spectrum. The 4 & 5 Star buildings have nice looking websites with published asking rents, virtual tours and plenty of details. The mom and pop investor may rent there apartments to someone without it ever seeing the internet, making that part of the 1 & 2 star data set less reliable. Yet, the data, as published, aligns with what we all know from Econ 101 (supply and demand) and what we see with our lying eyes. The new supply is generally concentrated in the A Class and the increase in A Class Inventory all over the country is striking. Meanwhile, C Class Inventory in most markets has stay the same or decreased over the past two decades. Palm Beach county has seen its stock of Class C multi-family housing reduced by 2.5%, while overall inventory increased by nearly 80% and the population grew by nearly 40%. None of this changes our outlook moving forward, but it adds nuance to what we are seeing in our local market. In regards to a distribution, we expect to make a distribution between $650,000 and $750,000 to the investor group near the end of Q3. We will be in touch to confirm wire instructions with each of you. We have included a preferred return update in each of your quarterly uploads, so that you are clear on, as of 6/30/2024, how much preferred return had accrued to your original investment. If you have any questions, please try to get them in prior to the distribution being made, so we can make sure to clear anything up. Thanks to all of you for your support. Please let me know if you have any questions or comments. -Clem