Dear Investors,

The first quarter has come to an end and we are off to an interesting start. Roughly a week before the quarter closed out, we agreed to sell 510 43rd Street to a local family office for $3.1 million. We paid $1.1 million in 2021, took a $715,000 loan on the property (which we invested elsewhere) and made capital improvements totaling roughly $330,000. That gives us an equity basis of approximately $715,000. Once we paid closing costs and our loan of roughly $625,000 there were $2.48 mm of proceeds. We allocated $1.75 mm of those proceeds to a 1031 Exchange intermediary, in order to avoid capital gains taxes on roughly 75% of the capital gains from the sale, and accepted approximately $620,000 of proceeds into our operating accounts. Overall, the multiple on invested capital (MOIC) of approximately 3.7 times our money in 3 years. We will hold on to 517 44th Street, another property in which this family office was interested, for the time being. It is unlikely the property will get less valuable over the long run, but, if this group is successful, we may have the opportunity to build and sell a pair of single family homes, as the property contains two buildable lots. Currently, they expect sale prices on homes in the neighborhood to range between $1.5 and $3 million, but I'd expect those numbers to increase if they find success.

Our search for exchange properties has already begun with offers going out on a handful of off-market properties, particularly those in close proximity to buildings we already own. The tax bill on the funds we accepted from the sale will be roughly $150,000-$165,000, depending on this year's depreciation figures and will be spread across all the partners on their 2025 tax return.

There is a good amount of work to do as we finish the renovations at 4011 36th Court and 233 Wenonah. At the time of writing, Australian Pines is having shower doors installed, while Wenonah is finishing its drywall installation. Elsewhere, we have also made some small improvements to specific apartments experiencing turnover in hopes of capturing increased now and over the coming 12-24 months.

For example, with each turn at 4011 36th Court, we are adding an island to each one bedroom kitchen and additional cabinetry to each studio kitchen, along with closet organizers for all apartments at 4011 36th and 3012 Broadway as well. These additions do not costs us much in the way of capital (our expense is typically recovered within a year in the form of increased rent). However, we are preparing to make sure these units stay at or near the top of the 'C' class market as we prepare for rents to increase again in the coming two or three years. Take a look at the below chart to see how Class C properties have performed in Palm Beach county. This shows you how Class C rents have grown faster than A or B, while inventories have stagnated over the past 20 years. Meanwhile, A and B class inventory has grown rapidly. Supply and demand at work!

With no new inventory in the construction pipeline in Palm Beach county (and many other markets as well), we can expect Class C properties to continue to outperform on rent in the long-term, making it all the more important we prepare our portfolio to capture those rent increases as they come.

With that said, in the short-term, rent growth for Palm Beach county, specifically within Class C properties remains positive, but only barely. You can see the chart below which demonstrates how 12 month rent growth has been dwindling as time goes on. Anecdotally, our experience has been that high quality tenants are more difficult to sign at the top of the market rents.

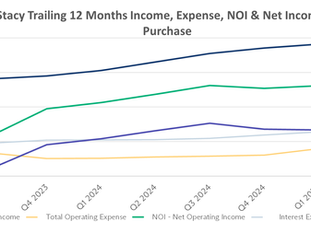

Around the portfolio, total 1st quarter rental income increased from $431,000 to

$463,000 on a year-over-year basis, though that is a slight step backwards on a

quarter-over-quarter basis (down from $470,000 in Q4). The majority of that

change was the result of two properties experiencing some vacancies which opened

up at the end of Q4 and began to fill at the end of Q1. Both 3012 Broadway and

510 43rd, had between two and three vacancies at any given time during the

quarter until Mid-March when a handful of leases were executed for April 1 and May

1. This underscores the importance of tenant retentions, which gives us an

opportunity to talk about the programs we have put in place and their early results.

There is no getting around how much more expensive it is to find a new tenant than

it is to keep an old one.

Let's take a look at 4011 36th Court and 3012 Broadway and get into what we are

doing to make improvements. At 4011 36th Court, the most recently completed

building has executed 14 leases for 12 units since it was finished at year-end 2023. There have been 9 renewals, two move-outs and one individual who comes due in

June. That's a 75% retention rate. Overall, the property has had a 49.1% retention

rate over the past 12 months. Our goal at this property is 60%, which may seem

low, but we think it realistic given the mix of units (30 one bedrooms and 32

studios). Here are the changes that were implemented in Q4 and we hope will

payoff with increased renewals this fall:

1) A review of required credit scores for each building with an increase of the

minimum scores at every building.

2) An increased focus on pet owners. Pet owners renew at higher rates than nonpet

owners*, so we are doing our best to accommodate them, particularly when the

mix leans towards smaller units, which turnover more frequently. This means

enforcing pet clean up rules more stringently and utilizing one of our maintenance

techs to clean up any remaining issues on a bi-weekly basis. It also means

beginning plans to install dog runs at multiple properties.

3) Instituting a move-in training for new tenants. This is done to ensure the

tenants understand how to use our software, which allows them to efficiently

communicate maintenance issues. Our tenants are occasionally significantly less

tech-savvy than your average citizen and it is important that we give them the tools

to use our systems. Otherwise, they get frustrate, have a bad experience and

move-out.

4) Instituting quarterly tenant check-ins. This allows us to stay on top of potential

deferred maintenance within the unit, but also to maintain a dialogue with the

tenants that transitions into a lease renewal offer 90 days prior to lease expiration.

These steps, we think should lead to an increase in our tenant retention over the

next couple years.

Over the past 12 months, 3012 Broadway had a tenant retention rate of 26.3%.

Obviously, we would like to do better, but we think this number is somewhat

natural for a brand new building filled with studios. Of those that did not renew, half

were not offered renewal, as we felt we could not only do better in terms of a

tenant profile, but could also improve upon the rent in a way the tenant was unlikely

(given their credit and income) to be able to afford. That turnover is almost entirely

complete and we can see the average credit score at the building begin to tick up.

As the year goes on and our lease ups at 4011 36th Court and 233 Wenonah

commence, I will continue to update you on the operational side, since that is where

we will generate returns now that the hard work of renovating most of the units is

generally complete.

As always, thank you for your support. Please let me know if you have any

questions or comments.

Regards,

Clem