Dear Investors, Underwriters and Friends,

This past quarter featured the first distribution from CT Stacy Road, a $750,000

distribution of capital and preferred interest. Total capital calls were $2,800,000,

so this distribution represents roughly 26.7% of called capital. Another

distribution, of $100,000, was made after the end of the quarter, on 10/1, which

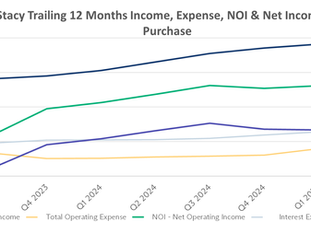

took the total distributions to roughly 30.3% of called capital. Here is the trailing

12 month income for each quarter since purchase:

At the end of Q3, Net Income was pushing just over $230,000 per year, which would be equal to roughly 9.15% of unreturned capital. We have two goals as we finish out the 9 remaining renovations: First) is to absorb the increase in interest expenses caused by the $1 million draw on our mortgage. The difference in annual interest is just under $60,000 per year. Second) is to push Net Income up over $275,000 per year to ensure that, once we have completed all renovations, preferred interest is being paid and reserves are being added to. From there, capital can be returned from a refinance or sale. Fortunately, we count between $7,500 and $8,000 of monthly rent increases available to us from the remaining renovations and that does not count rent increases that will come with renewals and turnover. With operating expenses settling in around $140,000-$150,000 per year when we include insurance and tax withholdings, we can make some projections about the value of the property using current cap rates for similar buildings. With 24 units leasing for $2,450 and a vacancy rate of 5%, you would end up with an NOI of $520,000. At a cap rate of 6.2%, you are looking at a building worth $8.4 million. That may seem high, so we can reduce the NOI by the additional taxes that will be incurred by the buyer to try and estimate a more realistic price.

In Q4, we will take a small slice of the funds drawn from our loan to repaint the building and restore the balconies. At the same time, our team is building storage in the back of the apartment building, which we will rent to tenants in need of extra space to keep their patios tidy. Once the storage is constructed and available for lease, those who cannot keep the front patios clean will incur fines.

The rate of distributions will likely slow for the next couple quarters as we push forward with a few renovations and, potentially, prepare for disposition. Excess funds will go into those renovations in an attempt to push our rent roll upwards towards $55,000 per month sooner, rather than later.

-Clem